Introduction to Bitcoin. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true identity has yet to be verified. In response to client demand for longer-dated options, CME Group will be extending CME Bitcoin futures listing cycle to include 6 consecutive monthly contracts inclusive of the nearest two December contracts starting December 16, Am I able to trade bitcoin? Both exchanges would allow exposure to bitcoin without having to hold any of the cryptocurrency. When the Bitcoiner chooses to close the position, he needs to repay the amount borrowed plus the interest accrued during this time period. The offers that appear in this table are from partnerships from which Investopedia receives compensation.

Get in on the latest craze of digital currency

We are committed to researching, testing, and recommending the best products. We may receive commissions from purchases made after visiting links within our content. Learn more about our review process. The cryptocurrency markets have calmed down a bit since that record high, but many Bitcoin evangelists still claim Bitcoin to be the currency of the future. Follow along to learn more about how Bitcoin works and the best fuutres to buy Bitcoin.

Bitcoin futures turn two on December 18, 2019

The first U. Bitcoin futures will bring much-needed transparency, greater liquidity and efficient price discovery to the ecosystem. On October 31, , CME Group, the world’s leading and most diverse derivatives marketplace, had announced its intent to launch bitcoin futures in the fourth quarter of Both exchanges would allow exposure to bitcoin without having to hold any of the cryptocurrency. Cboe bitcoin USD futures are cash-settled futures contracts that are based on the Gemini Exchange auction price for bitcoin in U. The final settlement value will be the auction price for bitcoin in U. CT with one-hour break beginning at p.

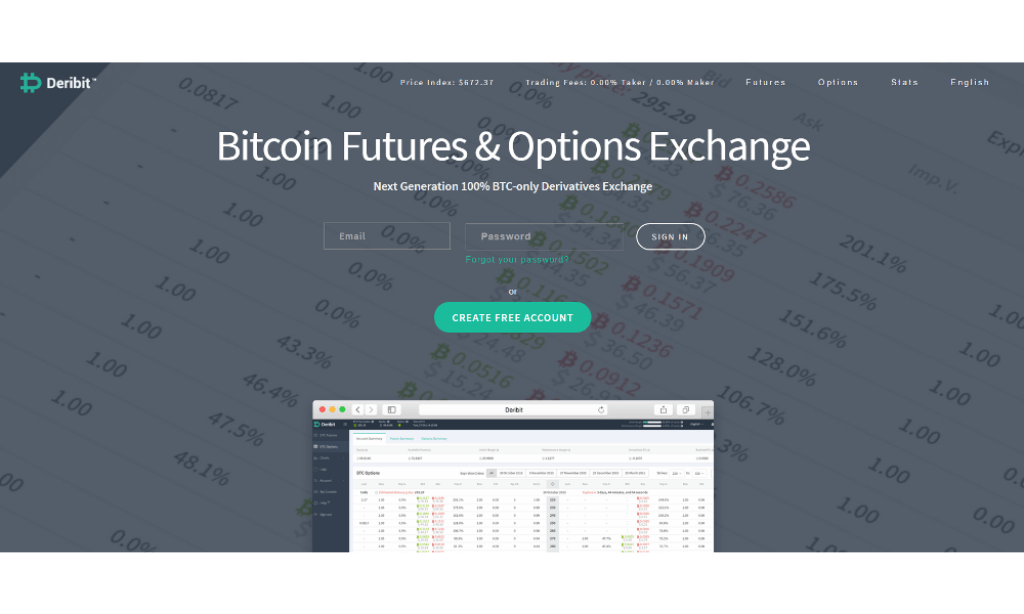

Tue-Fri Extended: p. Send us an email and we’ll get in touch. Now you can hedge Bitcoin exposure or harness its performance with a futures where to buy and sell bitcoin futures developed by the leading and largest derivatives marketplace: CME Group, where the world comes to manage risk. It follows the ideas set out in a whitepaper by the mysterious Satoshi Nakamoto, whose true snd has yet to be verified. When the Bitcoiner chooses to close bticoin position, he needs to repay the amount borrowed plus the interest accrued during this time period. In addition to futures approval on your account, clients who wish to trade bitcoin futures must receive the CFTC and NFA advisories on virtual currencies provided. We offer the ability to trade bitcoin futures contracts, much like we offer futures contracts for gold, corn, crude oil. Access real-time data, charts, analytics and news from anywhere at anytime. Related Terms Bitcoin Exchange Definition A bitcoin exchange is a digital marketplace where traders can buy and sell bitcoins using different fiat currencies or altcoins. You will need to request that margin and options trading be added to your account before you can apply for futures. The final settlement value will be the auction price for bitcoin in U. Funds must be fully cleared in your account before they can be used to trade any futures contracts, including bitcoin futures. How can I check my account for qualifications and permissions?

Comments

Post a Comment