As a result, users can trade for an extra 30 minutes before the market opens, as well as two hours after it closes. Robinhood founders Vlad Tenev and Baiju Bhatt were Stanford University students in when they launched the brokerage company. Investors should be aware that system response, execution price, speed, liquidity, market data, and account access times are affected by many factors, including market volatility, size and type of order, market conditions, system performance, and other factors. Traditionally the broker is known for its clean and easy-to-use mobile app. If you’re marked PDT while enrolled in Cash Management, you’ll be unenrolled from the deposit sweep program and will have your cash swept back from program banks. Trading in cryptocurrencies comes with significant risks, including volatile market price swings or flash crashes, market manipulation, and cybersecurity risks.

Popular Alternatives To Robinhood

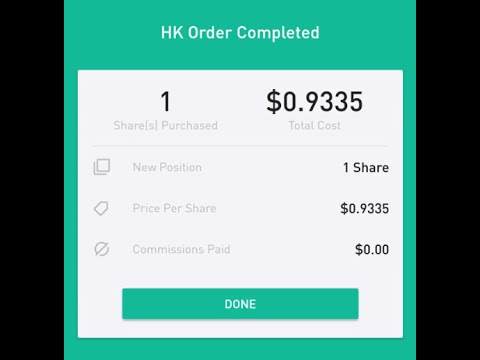

Robinhood is a stock brokerage that hopes to bring commission free trades of stocks to the masses. When they first came on the scene, I immediately thought robinhood app day trading Zecco. Zecco was a brokerage founded in that promised commission-free trades. The free trades got more and more restrictive. At the start, everyone had free trades. Eventually, there were limits on how often you could trade until TradeKing acquired them in So how is Robinhood different?

A Brief History

Robinshood have pioneered mobile trading in the US. Their offer attempts to provide the cheapest share trading anywhere. Robinhood is a streamlined trading brokerage that has gained serious traction for bringing online day trading to the masses through its free app. Specifically, it offers stocks, ETFs and cryptocurrency trading. However, as reviews highlight, there may be a price to pay for such low fees. With that being said, this review of Robinhood will examine all elements of their offering, including platforms, mobile app, customer service and accounts, before concluding with a final verdict.

Robinhood APP — How to AVOID the PATTERN DAY TRADER RULE! — For Unlimited DAY TRADING!

Account Options

Before using margin, customers must determine whether this type of trading strategy is right for them given their specific investment objectives, experience, risk tolerance, and financial situation. The information provided is not warranted as to completeness or accuracy and is subject to change without notice. Following customer reviews, the broker is also considering supporting alternative funding methods, including PayPal and virtual wallets. Note customer service assistants robinhood app day trading give tax advice. Margin trading involves interest charges and risks, including the potential to lose more than any amounts deposited or the need to deposit additional collateral in a falling market. Enabling pattern day traders to participate in the deposit sweep program would result in a number of potential day trade calls for those customers, so the industry standard is to disable deposit sweep programs for PDTs. Several federal agencies have also published advisory documents surrounding ribinhood risks of virtual currency. Robinuood regulatory purposes, each execution counts towards your day trade count, so trading low-volume stocks or placing especially large orders may increase your chances of executing a day trade. As product and platform reviews highlight, experienced traders may want to look elsewhere for sophisticated tools and additional resources. Day Trade Calls.

Comments

Post a Comment